If the employee is age 50 or older, catch-up contributions may also be allowed. Catchup contributions are allowed for employees over 50.įor SIMPLE plans, the elective deferral limit is 100% of compensation or $13,500 in 20. This limit remains the same at 100% of compensation or $13,500 in 2021. What is the SIMPLE plan contribution limit in 2021?Ĭompanies with fewer than 100 employees are eligible for a SIMPLE retirement savings plan. If you have already reached your maximum contribution limit, adding a cash balance plan can double or even triple your tax savings. Those who qualify to make catch-up contributions can put up to $63,500 into a Solo 401(k) for 2020. The total contribution amount allowed in 2020 is $57,000, though individuals over 50 can contribute an additional $6,500. What can you contribute to a Solo 401(k) plan in 2021?įreelancers, solopreneurs, and the self-employed can contribute to a Solo 401(k) plan as both employer and employee. A spouse may also participate in this plan for a maximum household savings of $116,000 (if you’re under 50) or $129,000 (if you’re over 50).Īdding a cash balance plan can help you maximize tax and retirement savings further, possibly doubling or tripling the amount set aside for your future. This figure also matters if you are a business owner, freelancer, or solopreneur with a Solo 401k, as you can contribute as both “employer” and “employee” to the 2021 maximum of $58,000. The combined employer and employee contribution limit is $58,000 in 2021.

#Max 401k contribution 2021 over 50 free

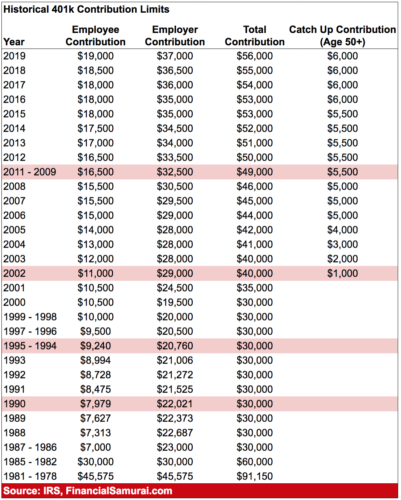

The employer match represents free money on top of the $19,500 individual limit that employees can earn just by participating in the plan. Most employer plans match some or all employee contributions. What is the combined employer/employee 401(k) limit in 2021? Depending on how well you’ve saved and how your cost of living has fared over the years, you may wish to increase contributions to allow for a more comfortable retirement. Those over 50 are getting closer to retirement. Sometimes the IRS adjusts the maximum limit based on “cost of living increases.” From 2018 to 2019, they increased the individual limit $500 from $18,500 to $19,000, and the total employer/employee contributions from $55,000 to $56,000.

If you’re self-employed, you can save $58K. The main individual 401(k) contribution limit remained the same, but the combined employer/employee max increased $1,000. Attaining the maximum contribution shields 401(k) plan participants from having to pay federal taxes on the amount contributed, while building the best possible nest egg for retirement. Some years, the limit increases $500 or $1,000 other years, the limit stays the same. The total combined employer/employee contribution is capped at $58,000.Įach year, the IRS announces whether it will raise the maximum allowable 401(k) contributions limit. If you’re over 50, you can contribute a total of $26,000. If your plan allows you to carry unused amounts into next year, the maximum you can carry over is $550.The individual 401(k) limit for 2021 is unchanged at $19,500. In 2021, you can save up to $2,750 in your health-care FSA – the same amount as 2020. Meanwhile, health-care FSAs generally must be used by the end of the plan year. You can roll your HSA balance from one year into the next, accumulating cash you can use in retirement. Savers who are 55 and over can contribute another $1,000.īe aware that HSAs aren't the same as health-care flexible spending accounts (FSAs). 3 election These are the income tax brackets for 2021 Four ways wealthy families are trying to block bigger estate taxes under BidenĪccountholders with family plans can save up to $7,200 in this account, an increase from $7,100 in 2020. More from Smart Tax Planning: 3 smart tax moves, no matter who wins the Nov. Next year, you can stash up to $3,600 if you're an individual with self-only health coverage, according to the IRS. That's different from your 401(k) contribution, which avoids income taxes at deferral but is subject to Social Security and Medicare tax. There's a sweetener to using the HSA at work: Contributions aren't subject to income, Social Security or Medicare taxes. You're able to tap the money free of taxes for qualified medical expenses. In this case, you save pretax or tax-deductible money into your HSA, where your funds grow tax-free. If you have a high-deductible health insurance plan next year, you might also have access to a health savings account. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)